The Average True Range (ATR) is an essential indicator that can significantly enhance trading strategies in platforms like Pocket Option. The Pocket Option ATR ATR Pocket Option can help traders gauge market volatility, making it a crucial tool for both novice and experienced traders. Understanding ATR can empower traders to make informed decisions, manage risk effectively, and seize trading opportunities across various asset classes.

Understanding ATR: The Basics

The Average True Range (ATR) was developed by J. Welles Wilder and serves as a volatility indicator. Unlike other indicators that gauge market direction, the ATR focuses on measuring the volatility of an asset, providing traders with insight into the price dynamics. It calculates the average of true ranges over a specific period, typically 14 days, and helps traders evaluate whether a market is experiencing high or low volatility.

How ATR is Calculated

To understand ATR, it’s crucial to grasp how it’s calculated. The true range (TR) of an asset is the greatest of the following three values:

- The difference between the current high and the current low.

- The difference between the previous close and the current high.

- The difference between the previous close and the current low.

Once the true range is established, the ATR can be calculated by averaging the true ranges over a defined period. The formula is as follows:

ATR = (Sum of True Ranges for n periods) / n

Where n represents the number of periods selected (e.g., 14), providing traders with a smoother average to better identify volatility trends.

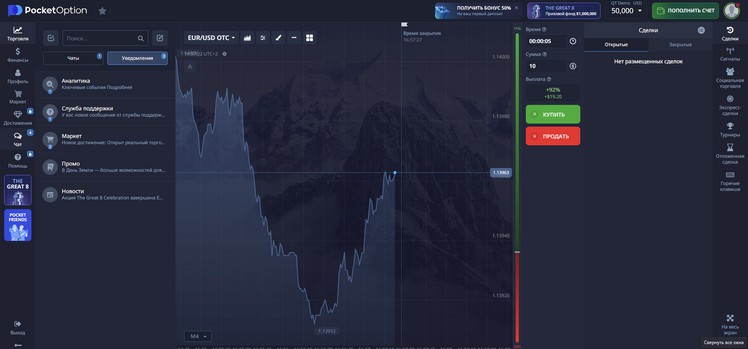

Using ATR in Pocket Option Trading

In the context of Pocket Option, the ATR indicator can be tremendously beneficial in developing a trading strategy. Here’s how you can effectively utilize ATR in your trading approach:

1. Identifying Market Volatility

ATR allows traders to identify whether an asset is experiencing high or low volatility. Generally, a high ATR value indicates a volatile market where prices are subject to significant swings. In contrast, a low ATR suggests a more stable market environment. By understanding these dynamics, traders can make better-informed decisions regarding entry and exit points in Pocket Option.

2. Setting Stop-Loss and Take-Profit Levels

The ATR can be utilized to set stop-loss and take-profit levels by factoring in market volatility. For instance, if the ATR is 50 points, a trader might set a stop-loss at 1.5 times the ATR value (75 points) to allow room for price fluctuations without prematurely closing the trade.

3. Trend Identification

When the ATR starts to increase, it typically indicates a rise in volatility, which can coincide with strong price moves. Conversely, a declining ATR may indicate consolidation or a potential reversal. Hence, using ATR can aid traders in recognizing trend shifts and adjusting their strategies accordingly.

Best Practices when Using ATR

While ATR can be an effective tool in trading, ensuring you follow best practices will optimize its effectiveness:

1. Combine with Other Indicators

ATR works best when used in conjunction with other technical indicators. For instance, combining ATR with moving averages, RSI, or MACD can provide a comprehensive picture of market conditions and increase the accuracy of trading signals.

2. Customize Your Period

Traders should consider customizing the period used for the ATR calculation based on their trading style. Short-term traders may prefer shorter periods to capture immediate volatility trends, while long-term traders might opt for longer periods to smooth out erratic fluctuations.

3. Stay Updated with Market Events

Market volatility can be influenced by news events, economic data releases, or geopolitical developments. Therefore, staying informed about upcoming events can help traders anticipate potential volatility spikes and adjust their strategies accordingly.

Common Mistakes to Avoid

Even experienced traders can fall into traps when utilizing ATR. Here are common mistakes to avoid:

1. Relying Solely on ATR

While ATR is a valuable tool, relying solely on it can lead to missing key market signals. Always integrate ATR with other indicators and analysis techniques to confirm trading decisions.

2. Misinterpreting ATR Values

ATR values are relative and can vary by asset. Therefore, comparing ATR values across different instruments can lead to misunderstandings. Focus on the asset you are trading and gauge whether the ATR aligns with historical volatility metrics.

Conclusion

The Pocket Option ATR indicator is a powerful tool that allows traders to measure market volatility effectively. By understanding its calculations and employing it to evaluate market conditions, set risk parameters, and identify trends, traders can enhance their trading strategies significantly. Remember, while ATR is beneficial, it should always be used in conjunction with other analysis methods and continuous market education for optimal results. Happy trading!