As forex trading involves such minor changes, many individuals favor to commerce with leverage. Starting your cryptocurrency trade enterprise with 100+ cryptocurrencies and integrating these features will certainly double up your corporation revenue. It is time to launch your crypto exchange enterprise platform wisely with varied trading options to make your cryptocurrency exchange platform a successful cryptocurrency margin trading one. Margin buying and selling is extra for short-term buyers, while futures are extra for long-term traders.

What Are The Everyday Margin Requirements On Crypto Exchanges?

In this publish, we provides you with every little thing that you should learn about crypto margin buying and selling. We may even provide you with some essential hints and ideas as well as look at a variety of the finest places to commerce on margin. This makes OKX one of many highest-leverage platforms compared to a most of 5X provided on Binance, KuCoin, and Kraken. However, there isn’t much choice to trade with margin using different altcoins, stablecoins, or fiat foreign money. In addition, KuCoin is famend for its crypto bot platform which could be utilized on the Futures platform.

Leverage That Means In Share Market

The predictive energy of Bitcoin futures information has been evidenced by its capacity to forecast realized volatility in the US inventory market index and sector indices. Intriguingly, high-frequency buying and selling statistics are instrumental in providing key predictors, significantly as a outcome of Bitcoin’s notable volatility. This setup lets folks speculate on Bitcoin’s value changes, aiming to revenue from ups and downs. Investors include institutional ones, retail merchants, and speculators who look into high volatility and market sentiment. Cryptocurrency is a type of decentralized forex and It’s a totally digital asset.

Ideas For Cryptocurrency Margin Buying And Selling And Buying And Selling Strategies

In analyzing Bitcoin value movements, futures and margin trading knowledge present useful insights. Leveraging high-frequency trading statistics and market evaluation can aid in predicting value volatility. It requires an understanding of danger management and funding methods because of the high stakes involved with leveraged positions within the unstable crypto market. These digital tokens can only be bought from devoted cryptocurrency exchanges. All the individuals buying and selling in the most popular cryptos, and naturally, you should anticipate to pay a fee for both buying and selling.

- Even although you’re technically utilizing borrowed funds, you can’t end up owing money to the platform, as this would create an enormous danger for the trade itself.

- We are explicit in providing a totally regularized and hassle-free functioning trade for buying/ promoting cryptocurrencies.

- Longing Bitcoin or different supported digital assets could be very easy and could be carried out on any of the above-listed crypto margin trading exchanges.

- Futures contracts are traded on futures exchanges such as the CME Group, the largest and most acknowledged on the earth, and are identified by their expiration month.

- Yes, crypto margin trading is legal, however its legality varies by jurisdiction and is topic to particular regulations.

Benefits And Risks Of Crypto Margin Buying And Selling

Typically, merchants must pay charges and perhaps interest on the borrowed funds along with different costs. Margin Trading platform has turn into more and more well-liked in the cryptocurrency and traditional monetary markets, allowing merchants to amplify their positions and potentially maximize profits. As we look ahead to 2024, it is crucial to remain informed about one of the best margin trading change platforms.

Some margin crypto exchanges might supply fewer order kind choices than others. Selecting the best crypto margin buying and selling trade is crucial for optimizing your buying and selling experience and managing risk. The platforms listed – from Binance for its numerous choices to ByBit for its high-leverage options and MEXC for its low charges – current unique strengths. Whether you’re a beginner in search of user-friendly interfaces or a complicated trader looking for excessive leverage, there’s an change tailor-made to your needs. ByBit is a feature-rich platform for margin trading in crypto property like Bitcoin (BTC) and ethereum (ETH).

The borrowed funds serve as collateral, and the platform might cost curiosity on the borrowed quantity. Here are the pros and cons of leverage trading in cryptocurrencies, balancing the potential for higher returns and hedging benefits with amplified dangers like losses and liquidation. Leverage enables merchants to borrow funds from an trade or broker, increasing their buying power. This borrowed capital is then utilized to open bigger positions than otherwise potential with their funds. Leverage is a financial instrument that enables traders to amplify their market publicity beyond their preliminary capital. It entails buying or selling cryptocurrencies at the going price on the market for immediate settlement.

Bybit presents 2x and 3x leverage on lengthy and quick tokens which then could be traded on the spot market or as a perpetual contract. It’s most popular by those who can analyze market trends and have the persistence to attend for the best second to enter and exit trades. The platform makes use of superior security features, together with two-factor authentication (2FA) and chilly storage for nearly all of its property, guaranteeing that user funds are well-protected. Additionally, Coinbase is amongst the few exchanges that’s publicly traded, further enhancing its credibility and transparency.

Since the complete account steadiness is used as collateral, you’ll be able to potentially open bigger positions. The in style platform offers four main markets to commerce which embody a spot trade, inverse perpetual, USDT perpetual and inverse futures. There can additionally be a ByBit referral promo that provides a deposit bonus for the ByBit futures market.

He covers blockchain, DeFi, and NFTs, with a concentrate on real-world asset tokenization and digital trust. Provide restricted to no investor protection, with users typically at mercy of the platform’s insurance policies. The only time you ought to not use leverage is if you’re a laissez-faire trader. Otherwise, leverage can be utilized successfully and profitably with correct administration. Like any sharp instrument, leverage must be dealt with with care – when you learn to do it, you haven’t got anything to fret about. To sum up, leverage just isn’t one thing you need to fear or use randomly, it’s the most highly effective weapon you may have as a dealer if you use it accurately.

Choosing one of the best bitcoin leverage trading platform is normally a troublesome process — there are numerous exchanges on-line at present that supply leveraged trading. Trading on the very best leverage crypto trading platform is not at all times the best option. Leverage trading entails utilizing borrowed funds to gain greater market exposure than one’s current steadiness permits. Leverage is usually said as a ratio or by indicating the multiplier with an “X.” For example, a 10X leverage allows you to set up a position 10 occasions bigger than your initial funding. Unlike margin buying and selling, leverage buying and selling doesn’t contain borrowing money that must be repaid with interest; as an alternative, you personal all of the features made from leveraged buying and selling.

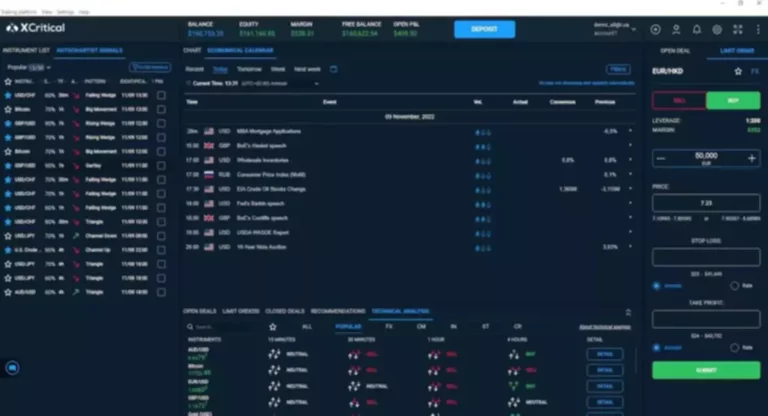

Read more about https://www.xcritical.in/ here.